MP Board Class 12th Economics Important Questions Unit 8 Money and Banking

Micro Economics Money and Banking Important Questions

Micro Economics Money and Banking Objective Type Questions

Question 1.

Choose the correct answers:

Question 1.

“Money is what money does”. Who said this:

(a) Hartley Withers

(b) Harte

(c) Prof. Thomas

(d) Keynes.

Answer:

(a) Hartley Withers

Question 2.

Function of money is:

(a) Medium of exchange

(b) Measure of value

(c) Store of value

(d) All of the above.

Answer:

(a) Medium of exchange

Question 3.

Meaning of money supply is:

(a) Money deposits in the bank

(b) Cash available with public

(c) Savings in the post office

(d) All of the above.

Answer:

(d) All of the above.

Question 4.

What is the Central Bank of India:

(a) Commercial Banks

(b) Central Bank

(c) Private Bank

(d) None of these.

Answer:

(a) Commercial Banks

![]()

Question 5.

Through which method we can withdraw money from the bank:

(a) Drawing letter

(b) Cheque

(c) A.T.M.

(d) All of the above.

Answer:

(d) All of the above.

Question 6.

Who is the guardian of Indian Banking System:

(a) Reserve Bank of India

(b) State Bank of India

(c) Unit Trust of India

(d) Life Insurance Company of India.

Answer:

(a) Reserve Bank of India

Question 7.

Narasimham Committee is related to what:

(a) Improvement in Taxation

(b) Improvement in Banking

(c) Improvement in Agriculture

(d) Improvement in Infrastructure.

Answer:

(b) Improvement in Banking

Question 2.

Fill in the blanks:

- Central Bank of India is………………..

- Bank rate is also known as………………..

- The bank generates……………….. deposits in credit creation.

- When CRR decreases, credit creation………………..

- Measure of deferred payment is ……………….. function of money.

- Medium of exchange is ……………….. function of money.

- The static and dynamic function of money is divided by………………..

Answer

- Reserve Bank of India

- Redemption

- Derivative

- Increases

- Secondary

- Primary

- Paul Einzig.

Question 3.

State true or false:

- Money is needed for day-to-day transactions.

- The precautionary demand for money increases with the proportionate increase in income.

- Reserve Bank of India provides loan to public.

- Along with the Reserve Bank of India, Commercial banks are also authorized to issue currency.

- Reliable money also include cheques.

- Reserve Bank of India cannot become the owner of any real estate.

Answer:

- True

- True

- False

- False

- False

- True.

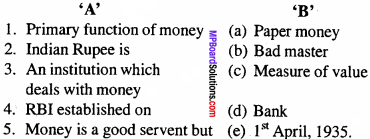

Question 4.

Match the following:

Question 5.

Answer the following in one word / sentence:

- Name the bank that provides long term loans to the farmers.

- Trade cycle is which evil of money?

- By increasing liquid fund ratio, which will be the effect on money supply?

- “The Banks are not only generators of money but are also creators of money”.

- Who has the right to issues paper money?

- When was NABARD established?

Answer:

- Agricultural or Cooperative banks

- Economic

- Decreases

- Sayer’s

- Central Bank

- 1982.

Micro Economics Money and Banking Very Short Answer Type Questions

Question 1.

Write two taboo works of Reserve Bank of India.

Answer:

Two taboo works of RBI are:

- Reserve Bank cannot accept deposits on interest from the public.

- Reserve Bank cannot provide loans for a fixed term.

Question 2.

What do you mean by overdraft facility?

Answer:

Clients who have current account with the bank are granted” the facility of withdrawing more money than actually lying in their accounts. It is called overdraft. This facility is available to reliable person for a short term.

Question 3.

What is commercial bank?

Answer:

Commercial banks are those banks who are established under the Indian Company Act, and they perform all the functions of banks.

![]()

Question 4.

Write the meaning of money.

Answer:

According to Prof. J.M. Keynes, Money is that by the delivery of which debt contracts and price contracts are discharged and in the shape of which a store of general purchasing power is held.

Question 5.

Write any two economic defects of Money.

Answer:

Two economic defects of money are:

- Money gives birth to trade cycle.

- Currency is the trust worthy custodian of money.

Question 6.

When was Reserve Bank of India nationalised?

Answer:

Reserve Bank of India was nationalised on 1st January 1949.

Question 7.

Which is the Central Bank of India? When was it established?

Answer:

Central Bank of India is Reserve Bank of India. It was established on 1st April, 1935.

Question 8.

What do you mean by Bank?

Answer:

Nowadays, the word ‘Bank’ is very common and popular so, general public is acquainted with it. Generally, bank means that institution which deals with transactions of money.

According to Prof. Wicksell:

“Bank is the heart and central point of modem currency system”.

Question 9.

Write definitions of money.

Answer:

According to Prof. Hartley Withers, “Money is what money does”. According to Prof. Seligman, “Money is one thing that possesses general acceptability”.

Question 10.

What is the problem of double coincidence of wants in barter exchange?

Answer:

1. Problem of double coincidence:

In barter system, goods are to be exchanged for goods, hence, it is essential that both the parties should need the goods which other has in exchange of their goods, then only the exchange is possible.

2. For example, ‘A’ possesses a chair and ‘B’ possesses a table. Now if ‘A’ wants to exchange his change for a table then he has to search a person, who needs chair in exchange of table. Thus, becomes a complex process for him to find such man.

![]()

Question 11.

‘Money is the medium of exchange,’ Explain.

Answer:

Medium of exchange:

This is the most important function of money. It acts as a medium of exchange. All the exchanges of goods and services are taken place in terms of money. (MPBoardSolutions.com) By paying predetermined price, money can be exchanged with the desired goods and services. A money has the general acceptability, therefore, all the exchanges in an economy take place in terms of money. It is because of this reason that money has been defined as generally acceptable purchasing power.

Question 12.

“Measure of value is the main function of money”. Explain.

Answer:

“Measure of value is the main function of money”:

The main function of money is that it measures the value of goods and services. In other words, the prices of all goods and services are expressed in terms of money. In ancient times it was not possible to measure the value of clothes and wheat. With the introduction of money, this difficulty of measurement disappeared and it became very convinient to measure the value of money. Money acts as a unit of account for all goods, wages salaries, interests etc. The national income, capital formation and other are measured in terms of money.

Question 13.

Write the importance of the money as the store of exchange value.

Answer:

Money acts also as a store of value because:

- Money can be stored very easily. Money is a liquid form of capital. It require less place to store.

- Money has the merit of general acceptibility.

- It is convinient to store money.

- Value of money remains relatively stable. Due to all these reasons money is important.

Question 14.

What is meant by money supply? What are its measures?

Answer:

Money supply refers to the total volume of money held by the public at a particular point of time in an economy.

Measures of money supply are:

M1 = Currency and coins with public + Demand deposits of Commercial banks + Other Deposites with RBI.

M2 = M1 + Savings deposits with post office Saving bank.

M3 = M2 + Net time deposits with banks.

M4 = M3 + Total deposits with post office saving bank.

Question 15.

Write difference between Scheduled Banks and Non – Scheduled Banks.

Answer:

Differences between Scheduled Banks and Non – Scheduled Banks:

Scheduled Banks:

- Scheduled banks are those banks whose names appear in the second schedule of RBI.

- The paid up share capital together with reserve fund must not be less than Rs. 5 lake.

Non-Scheduled Banks:

- Non – scheduled banks are those banks whose names do not appear in the second schedule of RBI.

- The paid up capital of such banks together with cash reserve is less than Rs. 5 lake.

Question 16.

If in an economy, all the customers of the bank deposit their money in the banks and if all of them withdraw their money from the bank then what will be its effect on the economy?

Answer:

If in any economy, bank customers deposit their money in the banks then there will be shortage of money for production and investment activity. As a result, the process of development will come to a stand still. In the same way, if all the customers withdraw their money from the banks, the banking would collapse and economy will face a problem. If in any bank financial crisis arises then central bank is the only bank to settle this problem and all banking systems will collapse.

Question 17,

Write the meaning of Commercial banks?

Answer:

A commercial bank is a financial institution which accepts deposits from the public and gives loans for purposes of consumptions and investment.

Companies Act, 1949:

A banking company is one which transacts the business of banking which means the accepting for the purpose of lending or investment of deposits of money from the public repayable on demand or otherwise and withdrawal by cheque or otherwise.

Question 18.

Write the types of Commercial bank.

Answer:

There are two types of Commercial banks:

1. Scheduled banks:

Scheduled banks are those banks whose names appear in the second schedule of RBI.

2. Non – scheduled banks:

Non – Scheduled banks are those, banks whose names do not appear in the second schedule of RBI. In other words, those banks which do not fulfill the requisite conditions as explained above are called non-scheduled banks.

Question 19.

What is paper money?

Answer:

Paper money is a country’s official paper currency that is circulated for transaction related purposes of goods and services. The printing of paper money is typically regulated by a country’s Central bank / treasury in order to keep the flow of funds in line with monetary policy.

Paper money is that money which is issued by the order of the government. Paper money is in the form of paper notes or currency notes. In India, the Reserve Bank of India enjoys the sole monopoly of issuing currency notes (Paper money).

![]()

Question 20.

What do you mean by money supply?

Answer:

Supply of money is a stock concept. It refers to total stock of money (of all types) held by the people of a country at a point of time.

Question 21.

What do you mean by Fiat money or Legal tender money?

Answer:

Fiat money which serves as money on the basis of fiat (order) of the government It is issued by authority of the government. It includes notes, coins.

Question 22.

What do you mean by C.R.R.?

Answer:

Commercial banks are required under law to keep a certain percentage of their total deposit in the Central bank in the form of cash reserves. This is called Cash Reserve Ratio (C.R.R.).

Question 23.

What do you mean by credit money?

Answer:

It refers to that money of which money value is more than commodity value.

Question 24.

Why is paper money called the Legal tender money?

Answer:

Paper money or Paper notes are called as legal tender money because nobody can refuse its acceptance as medium of exchange. It is legal tender. It means people have to accept it legally for different payments.

Question 25.

What do you mean by high powered money?

Answer:

It consist of currency (Notes and Coins in circulation with public and valt cash of commercial banks) and deposits held by the government of India and commercial banks with R.B.I.

Micro Economics Money and Banking Short Answer Type Questions

Question 1.

“Money is a good servant but a bad master”. Explain.

Answer:

Money is becoming essential part of life, it is controlling our activities in such a way that we are completely under it. It should be means but is has become end of life. Till money acts as servant it is useful for human being but as money goes out of control it becomes harmful for the entire economy. This situation arises when supply of money exceeds its demand. Money becomes master instead of servant. It has become the only means of satisfying our wants. We cannot think of our life without money that is why, it is said that “money is good servant but a bad master.”

Question 2.

Define Central bank.

Answer:

Central bank of any country is the highest financial institution of that country. All other banks of the country work under its guidance. According to bank of international settlements. “The central bank in any country is that which has been entrusted the duty of regulating the volume of currency and credit in the country”.

Question 3.

What do you mean by clearing house of Central bank?

or

How Central bank does the work of clearing house?

Answer:

Clearing house:

Representatives of different banks in a city meet at the clearing house of the Central bank. Payments from one bank to other bank are settled through a simple book of adjustments without involving transfers of funds. Daily differences in the clearing between the banks are adjusted by means of debit and credit entries in their respective account with the Central bank.

Question 4.

Write two advantages and defects of Commercial banks.

Answer:

Following are the two advantages of commercial banks:

1. Use of savings for production purposes:

Banks collects small and big savings of the country and use them for various purposes. Banks provide timely financial assistance to traders and industries. Banks help in the distribution of surplus capital in regions where it is not wanted to those regions where it can be used. Large scale transactions would be quite impossible without banks.

2. Facility of capital transfer:

Banks spend money from one place to another easily in less time. They send it through draft, cheques, etc. For the development economy money can be transferred from one place to another.

Defects of commercial banks:

1. Less banking facilities:

Compare to other countries there are less banking facilities available in India.

Some banks do not get proper guidance and instructions from reserve bank of India. It has unfavourable effect on banking system. So, Indian Commercial banking system has not succeeded in attracking the Indian public.

2. Inefficiency:

Most of the commercial banking systems are unable to provide efficient and quick services to their customers. Moreover in India the distribution of commercial banks are in imbalance way.

![]()

Question 5.

Differentiate between Reserve Bank and Commercial Bank.

Answer:

Differences between Reserve Bank and Commercial Bank:

Reserve Bank:

- It is the highest bank of India. It is a controlling bank.

- There is only one central bank (Reserve bank) in India.

- It enjoys the monopoly right for note issue.

- It has no dealing and direct relation with public.

- The ownership of this bank is in the hands of central government.

Commercial Bank:

- It is a part of banking system. It is con trolled by Reserve Bank of India.

- There are many commercial banks in India.

- A commercial bank does not have such right.

- It has direct relation and dealing with public.

- The ownership of this bank is in the hands of government or public.

Question 6.

Why is speculative demand for money inversely related to the rate of interest?

Answer:

Speculative demand for money is made for return in the form of interest. Hence, rate of interest determiners the speculative demand for money of the rate of interest higher the speculative demand for money will be low and vice-versa. The reason is that people will convert their money in bonds when the interest on bond is higher.

In that case, demand for speculative purpose will be low. On the other hand, the rate of interest is lower than the expected interest, people will not convert their money in bonds and keep money in hand for speculative purpose. In this way, a specular demand for money in inversely related to the of interest.

Question 7.

What role of RBI is known as lender of last resort?

Answer:

Lender of last resort:

The Central Bank aslo plays the role of last resort. Lender of last resort means that a Commercial Bank fails to meet his financial requirements from other sources, it can as a last resort, approaches to the Central Bank for loans and advances. The Central Bank consists such bank through discounting of approved securities and bills of exchange. As a last resort, Central Bank exercise control over the entire banking system of the conuntry.

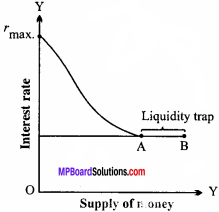

Question 8.

What is liquidity trap?

Answer:

Liquidity Trap:

Everyone in the economy holds his wealth in money balance and if additional money is injected within the economy, it will be used to satiate people’s craving for money balances without increasing the demand for bond and without further lowering the rate of interest below the flow min. Such a situation is called liquidity trap.

Question 9.

What is barter system? What are its defects?

Answer:

Barter system:

Barter system means the exchange of goods and services directly for goods and services. In other words economic exchange without the medium of money is referred to as Barter system.

Drawbacks of barter system : Following are main drawbacks of the barter system:

1. Lack of double coincidence:

The lack of double coincidence of wants is the major drawback. It is very rare when the owner of same goods or service could find some are who wants his good or service and possessed that good service that the first person wanted. No exchange is possible if the double coincidence is not there.

2. Absence of common unit of measurement:

The second main drawback of barter is the absence of a common unit of measurement in which the value of goods and services can be measured. In the absence of a common unit proper accounting system is not possible.

3. Lacks of standard deferred payments:

Thirdly, the barter system lacks any satisfactory unit to engage in contracts involving future payments. In a barter economy future payments would have to be stated in specific goods of services which may involve disagreement over the quality of goods or even on the commodity used for repayment.

4. Lack of storing wealth:

Fourthly, the barter system does not provide for any method of storing purchasing power.

Question 10.

Suppose a bond promises Rs 500 at the end of two years with no intermediate return. If the rate of interest is 5% per annum, what is the price of the bond?

Answer:

= 500 x \(\frac { 1 }{ \left\lceil 1+\frac { 5 }{ 100 } \right\rceil \left\lceil 1+\frac { 5 }{ 100 } \right\rceil } \)

= 500 x \(\frac { 20 }{ 21 }\) x \(\frac { 20 }{ 21 }\)

=\(\frac { 10,000 x 20 }{ 21 x 21 }\)

=\(\frac { 2,00,000}{ 441 }\)

= Rs 453.51.

Micro Economics Money and Banking Long Answer Type Questions

Question 1

What do you mean by stock of money and flow of money?

or

Write the differences between the stock of money and flow of money.

Answer:

Differences between Stock of money and Flow of money:

Stock:

- Stock is related to a point of time.

- A stock is a quantity measurable at a particular point of time such as 10:00 am etc.

- It has no time dimension.

- National capital is stock.

- It is a static concept.

Flow:

- Flow is related to a period of time.

- A flow is a quantity which is measured over a specific period of time such as an hour, a day, a week etc.

- It has time dimension.

- National income is a flow.

- It is a dynamic concept.

Question 2.

Explain five functions of RBI in detail.

Answer:

Followings are the functions of Reserve Bank of India:

1. Issue of currency notes:

The Reserve Bank of India has been given the monopoly of issuing currency notes. At present, it is authorised to issue currency notes in the denomination of Rs. 5,10,20,50,100,500 and 2,000. One rupee note and coins are issued by government of India. The notes issued by R.B.I. are legal currency.

2. Credit control:

The main functions of R.B.I. is to control and regulate volume of credit and currency in India. It controls the credit granted by commercial banks. It controls the credit inflationary impact of the ever increasing development financing in five year plans. R.B.I. controls the credit by increasing or decreasing bank rates buying and selling government securities in the open market, by increasing the cash reserves, by issuing specific directions to banks etc.

3. Banker agent and advisor to government:

The reserve bank of India acts as banker, agent and advisor to the central and state governments. As a banker to government R.B.I. performs many functions. It manages the public debt, makes all payments, receives all the revenues in government account managing foreign exchange, etc. R.B.I. has appointed experts of all fields of specialization who gives proper advice to central and state governments in various matters from time-to-time.

4. Banker’s bank:

R.B.I. is banker to banks in India. It accepts deposits of commercial banks and lends of them from time – to – time. It extends short term loans and advances against eligible securities and promissory notes. It makes purchases and sales of foreign currencies also. The commercial and other banks have to deposit with R.B.I. a certain percentage of their total liabilities to enjoy various facilities from it.

5. Foreign exchange management:

R.B.I. controls all receipts and payments in foreign exchange under F.E.M. A. All payments to be made in foreign exchange exceeding the limit prescribed under the act must seek RBI’s permission.

![]()

Question 3.

Explain the methods to control the credit taken by the reserve bank.

Or

Explain how the Reserve Bank of India controls credit.

Answer:

Followings are the methods to control the credit:

1. Bank rate:

The rate at which Reserve Bank of India gives loan to other banks on the basis of securities is called bank rate. R.B.I. increases or decrease the bank rate for reducing or expanding the credit from time-to-time.

2. Activities of open market:

R.B.I. buys and sells the government securities in the open market for expanding and reducing the volume of credit. This is called open market operation. By this activities R.B.I. increases or decreases the amount of money.

3. Changing the ratio of bank’s reserves:

R.B. I. controls the credit by increasing the percentage of cash reserves which is kept by scheduled commercial banks compulsorily with R.B.I.

4. Liquidity ratio-system:

Reserve Bank of India increases or decreases the liquidity ratio for reducing or expanding credit.

5. Selective credit control policy:

Reserve bank adopts the selective credit control policy in respect of certain commodities which have been sensitive.

6. By issuing specific directions to banks:

R.B.I. issues specific directions to banks in general regarding lending rates.

7. Increase or Decrease refinancing facility:

R.B.I. increases or decreases refinancing facility to commercial banks for credit control. Rigid attitude for refinancing reduces credit and liberal attitude for refinancing expands credit.

Question 4.

Suggest some measures to remove the defects of commercial bank.

Answer:

Following steps should be taken to improve the conditions of Indian commercial banks:

- For the balance development of commercial banks their new branches should be open in villages and backward areas.

- To solve the problem of shortage of capital the money deposits schemes of the banks should be made attractive.

- Knowledge and education regarding the banks should be given clearly.

- For increasing the banking systems the trained and efficient officers should be appointed.

- Reserve bank should make such rules which will control the corruption in the banking system.

- Banks should follow the policy of cooperation with other banks instead of following the policy of competition with each other.

Question 5.

Write any five functions of Commercial Banks.

Answer:

Following are the functions of Commercial banks:

I. Primary Functions

1. Acceptance of deposits:

All commercial banks accept money on deposits. By taking money on deposits a bank provides safe keeping for people’s money. For deposition of money a bank provides facility of five types of customer accounts:

- Current account

- Fixed deposit account

- Savings bank account

- Home savings account and

- Recurring deposit account.

2. Lending and Investment:

The second primary function of a bank is to lend money to borrowers bank keeps a part of the total deposits with itself as cash reserves and lends the balance. Bank charges interest on such lending of money, which is also the main source of profit to most of the banks. Money lending may be in the form of overdrafts, cash credits or loans.

II. Subsidiary Functions

In order to provide several kinds of facilities to their customers commercial banks perform many functions. They are as follows:

1. Issuing of credit instruments:

All commercial banks issue various instruments of credit such as bill of exchange, hundi, draft and cheque etc.

2. Arrangement of foreign exchange:

For foreign trade banks convert the currency of one country into the currency of another country. This work is done by exchange Banks.

3. Keeping valuables safely:

Banks provide the facility of lockers for the customers to keep their valuable things gold, diamonds, Jewellary etc. are kept in these lockers.

4. Discounting of bills of exchange and hundies:

Banks discount the bill and hundies of their customers before the date of maturity of such instruments.

5. Collecting payments:

Commercial banks collect payments of their customers bills, cheques and hundies etc. Banks charge commissions for these services.

6. Making payments:

Banks make payments on behalf of their customers. The make payments of installments of loans, interest, donations, insurance etc.They charge nominal commission for their services.

7. Selling and Purchasing of securities:

Commercial banks sell and purchase shares, debentures Govt.bonds etc.

Question 6.

What are the main functions of money? How does money remove the defect of barter system?

Answer:

Followings are the functions of money:

Primary Functions:

1. Medium of exchange:

This is the most important function of money. It acts as a medium of exchange. All the exchanges of goods and services are taken place in terms of money. By paying predetermined price, money can be exchanged with the desired goods and services.

2. Measure of value:

The second basic function of money is that it measures the value of goods and services. In other words, the prices of all goods and services are expressed in terms of money. In ancient times it was not possible of measure the value of clothes and wheat. With the introduction of money this difficulty of measurement disappeared and it became very convinient to measure the value of money. Money acts as a unit of account for all goods, wages salaries, interests etc. The national income, capital formation and other are measured in terms of money.

3. Store of exchange value:

Money can be stored very easily. Money is a liquid form of capital. It require less place to store. There is very less fluctuation in the value of money in comparison to goods. That is why mentry to save a part of their income for future. Money provides a base for store value.

Store of value means store of wealth.People can now keep their wealth in the form of money. Under barter system, storing of wealth was possible only in terms of commodities which had its defects like perishable nature of some goods, cost of storage etc. But storing of value in the form of money has solved all these difficulties. It was Keynes who first realised the store value function of money. He regarded money as link between the present and the future. Money allows us to store purchasing power which can be used at any time in future to purchase goods and services.

4. Transfer of value:

With the economic development the trade and commerce also increased rapidly. This causes the need of transfer of money from one place to another. Sometimes it crosses the national boundary too. Money is a liquid assets so it can be transferred from one place to another.

Through money, value can be easily and quickly transferred from one place to another because money is acceptable everywhere. For example a person can transfer money from Katakana to Delhi through bank draft, bill of exchange etc. Money thus, facilitates movement of wealth and capital. Under barter system it was difficult to transfer value in the from commodities.

![]()

Question 7.

Explain the functions of commercial banks. (Any two)

Answer:

Functions of a Commercial Bank:

Following are main functions of a commercial Bank:

1. Acceptance of deposits:

This is an important primary function of the Commercial Banks. The Commercial Banks accept deposits from individuals, business firms and other institutions. This is economically useful function in the sense that it helps in the mobilization of savings for production purposes. The commercial banks accept deposits in several forms according to the requirements of different sections of the society.

2. Advancing of Loans:

Extending loans is another important primary function of the commercial banks. It is also the main source of their income. Traditionally, bankers charged a service charge from the depositors, as they did not use the deposits for lending purposes. Gradually, they realized that.there is no point in keeping all the money which they received from depositors as revenue. All the depositors never approached bankers to withdraw their money at one point of time. In the beginning, their lending out of deposits were confined to short term loans to provide working funds for current business operations.

Now, banks have extended their lending activities to investment in long term bonds. Furthermore, today, commercial banks lend to consumers and government units besides financing trade and industry to meet the divergent needs of their customers. In the manner, they could find safe and lucrative outlets for their funds. The normal performance for banks is for secured loans, but they often give loans to business firms of high credit standing without security. .

Question 8.

What is money multiplier? How will you determine its value?

Answer:

Money multiplier:

Money multiplier may be defined as “the ratio of the stock of money to the stock of high powered money in an economy.” In equation:

Money multiplier = \({ M }{ H }\)

M = Stock of money

H = Stock of high powered money in an economy

The value of money multiplier is greater than 1. The value of money multiplier is determined by applying the following formula:

Money multiplier = \({ 1- cdr }{ cdr – rdr }\)

Method of finding out multiplier

Supply of money = Money + Deposit

M = Cu + DD

= (1 + Cdr) DD

Cdr = Cu / DD

H = Cu + R

= CdrDD + rdr DD

= (Cdr + rdr) DD

Money multiplier = M/H

\(\frac { (1+Cdr)DD }{ (Cdr+rdr)DD }\) = \(\frac { 1+Cdr }{ Cdr+rdr }\)

1 + Cdr > Cdr + rdr.

![]()

Question 9.

What are the methods adopted by Reserve Bank of India to regulate the credit?

Answer:

There are those instruments of monetary policy which after overall supply of money / credit in the economy. They are as follows:

1. Bank Rate:

The bank rate is the minimum rate at which the Central Bank of a country (as a lender of last season) is prepared to give credit to the Commercial Bank. The increase in bank rate increases the rate of interest and credit becomes dear. Accordingly, the demand for credit is reduced. On the other hand, decrease in the bank rate lowers the market rate of interest charged by the commercial banks from their borrowers. Credit becomes cheap. The Reserve Bank adopts dear money policy when the supply of credit needs to be reduced during periods of inflation. It adopts cheap money policy when credit needs to be expanded during deflation.

2. Open Market Operations:

Open Market Operations refer to the sale and purchase of securities in the open market by the Central Bank. By selling the securities (like, National Saving Certificates-NSCs), the Central Bank withdraws cash balances from within the economy. And, by buying the securities, the Central Bank contributes to cash balances in the economy.

3. Cash Reserve Ratio (CRR):

It refers to the minimum percentage of a bank’s total deposits required to be keep with the Central Banks. Commercial Banks have to keep with toe Central Bank a certain percentage of their deposits in the form of cash reserves as a matter of law. When the cash flow or credit is to be increased, minimum reserve ratio is reduced and when the cash flow or credit is to be reduced, minimum cash reserve ratio is increased.

4. Statutory Liquidity Ratio (SLR):

Every bank is required to maintain a fixed percentage of its assets in the form of cash or other liquid assets, called SLR. With a view to reducing the flow of credit in the market, the Central Bank increases this liquidity ratio. However, in case of expansion of credit, the liquidity ratio is reduced.

Qualitative Method of Credit Control

Or

Qualitative Instruments of Monetary Policy

1. Margin Requirement:

The margin requirement of loan refers to the difference between the current value of the security offered for loans and the value of loans granted. Suppose, a person mortgages an article worth Rs 100 with the bank and the bank gives him loan of Rs 80. The margin requirement in this case would be 20 percent. In case, the flow of credit is to be restricted for certain specific business activities in the economy, the margin requirement of loan is raised for those very activities. The margin requirement is lowered in case the expansion of credit is desired.

2, Rationing of Credit:

Rationing of credit refers to fixation of credit quotas for different business activities. Rationing of credit is introduced when the flow of credit is to be checked particularly for speculative activities in the economy. The Central Bank fixes credit quota for different business activities. The Commercial Banks cannot exceed the quota limits while granting loans.