MP Board Class 11th Business Studies Important Questions Chapter 4 Business Services

Business Services Important Questions

Business Services Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

It is necessary for e – business –

(a) Computer system

(b) Internet connection

(c) Trained staff

(d) All the above.

Answer:

(d) All the above.

Question 2.

Best mean for making online payment

(a) Digital cash

(b) Credit or Debit card

(c) Cash on delivery

(d) Net – banking transfer.

Answer:

(b) Credit or Debit card

Question 3

Is plastic money :

(a) Banking transfer

(b) Cheque

(c) Digital cash

(d) Credit card

Answer:

(d) Credit card

Question 4.

DTH services are provided by –

(a) Transport companies

(b) Bank

(c) Cellular companies

(d) None of these.

Answer:

(a) Transport companies

Question 5.

It is included in the public collection –

(a) Control

(b) Flexibility

(c) Both (a) and (b)

(d) None of these.

Answer:

(c) Both (a) and (b)

Question 6.

Which is not included in Insurance work –

(a) Division of risk

(b) Helpful in capital formation

(c) To give loan

(d) None of these.

Answer:

(c) To give loan

Question 7.

Risk in online transaction –

(a) Division of risk

(b) Duplicacy of Information

(c) Misuse of Information

(d) None of these.

Answer:

(d) None of these.

Question 8.

In life Insurance contract which is not applicable –

(a) Conditional contract

(b) One prided contract

(c) Principle of compensation

(d) None of these.

Answer:

(c) Principle of compensation

Question 9.

Meaning of CWC is –

(a) Center water commission

(b) Central warehousing commission

(c) Central warehousing corporation

(d) Central water corporation.

Answer:

(c) Central warehousing corporation

Question 10.

Which is not a service –

(a) Hair cutting

(b) Transport

(c) Book

(d) Recreation.

Answer:

(c) Book

Question 11.

How many differences had been given between goods and services by the scholars –

(a) 4

(b) 5

(c) 6

(d) 12

Answer:

(b) 5

Question 12.

Which is biggest Retail Bank –

(a) SBI

(b) HDFC

(c) Post office

(d) ICICI

Answer:

(a) SBI

![]()

Question 13.

Goods are stored in –

(a) Warehouses

(b) Keeping in open

(c) Buildings

(d) None of these

Answer:

(a) Warehouses

Question 14.

Import – Export Bank is –

(a) Commercial Bank

(b) Central Bank

(c) Cooperative Bank

(d) Special Bank.

Answer:

(d) Special Bank.

Question 15.

Which is primary function of the Bank –

(a) Issue of credit letter

(b) Keeping valuables

(c) Accepting deposits

(d) Giving loan for Education.

Answer:

(c) Accepting deposits

Question 16.

Which Bank do not work in private sector –

(a) Lord Krishna Bank

(b) Global Trust Bank

(c) Development credit bank limited

(d) Canara Bank.

Answer:

(d) Canara Bank.

Question 17.

How many digits are there in PIN (Number) –

(a) 4

(b) 6

(c) 5

(d) 7.

Answer:

(b) 6

Question 18.

Which is not characteristics of Private courier service –

(a) Fastest means of communication.

(b) Transports gold from one place to another

(c) They provide both National and International services

(d) They take responsibility of transferring goods and services at the proper time.

Answer:

(d) They take responsibility of transferring goods and services at the proper time.

Question 2.

Fill in the blanks:

- ATM is a form of …………….. banking.

- When all the work of bank is done by computer then it is called ……………..

- The bank which is concerned with import and’export is called ……………..

- NABARD was established on ……………..

- The main base of insurance is ……………..

- Postal department was established in India in ……………..

- In V.P.P. insurance, more than………….. is needed.

- Pin code was implemented on………… in India.

- The one line wireless system which receives information in written form and record, it is called ……………..

- Nationalisation of life insurance corporation was done in India in the year ……………..

- Commercial Bank accept …………….. from public.

- ……………… possess the right of issuing currency in India.

- ……………… is used to protect the goods.

- Reserve Bank is considered as a …………….. of India.

- Banking Act, constituted in India in ……………..

- In insurance two parties are agreed in contract for ……………..

- E – mail service is based on computer system is a …………….. communication system.

- For preserving goods we used ……………..

Answer:

- Electronic

- E – Banking

- Axim bank

- 1982

- Co – operation

- 1854

- 500

- 15 August, 1972

- Pazer

- 1996

- Deposit

- Central Bank

- Warehouse

- Central Bank

- 1949

- Compensation contract

- Store and forward

- Storage.

![]()

Question 3.

Write true or false:

- Insurance is a valid consideration for contract.

- R.B.I. arranged foreign money for International business.

- Regional Development Bank started in 1948 in India.

- To fill a form is necessary for postal order.

- By money order we can send maximum amount up to Rs 2000 to others.

- Foreign exchange communication Ltd is established in 1986.

- In A.T.M. the messages are transferred in written form.

- Credit card provide the facility of bank overdraft.

- By fax we can send written messages.

- Exchange of thoughts and information is called communication.

- World bank is a International Bank.

- Smart card is not a part of E – banking.

- Fire insurance started in India in 1966.

- In India first postal stamp issued in 1952.

- Holding generate fluctuations in prices.

Answer:

- True

- False

- False

- False

- False

- True

- False

- True

- True

- True

- True

- False

- True

- True

- False.

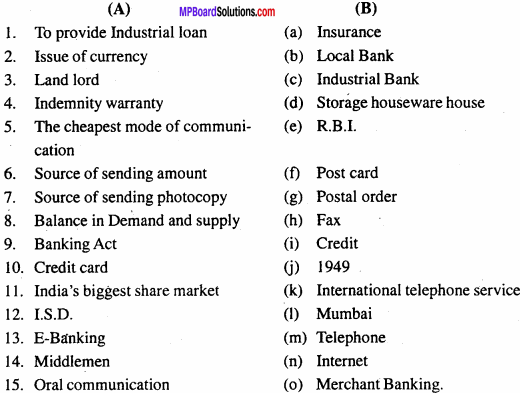

Question 4.

Match the columns:

Answer:

1. (c)

2. (d)

3. (b)

4. (a)

5. (f)

6. (g)

7. (h)

8. (e)

9. (j)

10. (i)

11. (l)

12. (k)

13. (n)

14. (o)

15. (m)

Question 5.

Give answer in one word/sentence:

Question 1.

Full form of WWW?

Answer:

World Wide Web.

Question 2.

Father of Internet?

Answer:

Winton G. Surf.

Question 3.

Full form of ATM?

Answer:

Automated Teller Machine.

Question 4.

Which kind of warehouse is IFC?

Answer:

Government warehouse.

![]()

Question 5.

Which organization deals in monetary transaction and transfers?

Answer:

Bank.

Question 6.

Full form of VPP?

Answer:

Value Payable Post.

Question 7.

Advertize and Insurance belong to which sector?

Answer:

Tertiary / Service sector.

Question 8.

Those centres where 24 hours money withdrawal facility is available?

Answer:

ATM.

Question 9.

Which Bank deals in foreign currency?

Answer:

Foreign Exchange Bank.

Question 10.

What is process of sending information through computer is called?

Answer:

E – mail.

Question 11.

By which name that Insurance is called where the premium is to be paid for limited time?

Answer:

Lifetime Insurance letter.

Question 12.

Which Insurance do not come under compensation contract?

Answer:

Life Insurance.

Question 13.

What is term of fire Insurance?

Answer:

One year.

Question 14.

How many parties are there in fire Insurance?

Answer:

Two.

Question 15.

Which Insurance letter have surrender Value Zero?

Answer:

Fire Insurance.

Question 16.

Which Insurance provide safety and Investment both?

Answer:

Life Insurance.

Question 17.

When postal services started in India?

Answer:

1837.

Question 18.

What is PPF?

Answer:

Public Provident Fund.

Question 19.

Which is latest communication mean?

Answer:

Internet.

Question 20.

Overdraft facility is given on which account?

Answer:

Only current account.

Question 21.

Give any four services which are provided by the postal department.

Answer:

- Speed post

- Greetings

- Media Information

- Passport services.

Question 22.

What do you mean by communication?

Answer:

Transfer of thoughts or messages among two or more persons either in oral or written form is called as communication.

Question 23.

Write the types of Telecom services.

Answer:

- Cellular mobile services.

- Radio passing services.

- Permanent line services.

Question 24.

Write full form of STD and ISD?

Answer:

- STD: Subscriber trunk dialing.

- ISD: International subscriber dialing.

Question 25.

How many post offices are there in India?

Answer:

154149.

Question 26.

With how many countries Indian Postal Department have network of services?

Answer:

97 countries.

Question 27.

With how many countries transfer of money to India is possible?

Answer:

185 Countries.

Question 28.

Write full form of DTH.

Answer:

Direct to Home.

![]()

Question 29.

What is crossing of cheque ? How many types are there?

Answer:

When two parallel lines are drawn at the left top comer of the cheque then it is called as crossing of cheque. There are two types:

- General crossing

- Special crossing.

Business Services Very Short Answer Type Questions

Question 1.

What do you mean by Commercial Bank?

Answer:

Banks who facilitates proper economic management for a business and provides short term loans are called Commercial Banks. They are Joint Stock Banks because their capital is divided into many shares.

Question 2.

Write meaning of Insurance.

Answer:

Insurance is a contract in which one party agree to compensate an agreed sum if money to another party in returns of a consideration on happening of a particular event. Insurance provides security against risks.

Question 3.

Write the types of Insurance?

Answer:

There are four types of Insurance:

- Life Insurance

- Fire Insurance

- Marine Insurance

- Miscellaneous Insurance.

Question 4.

Define communication?

Answer:

The transfer of ideas and informations among two or more persons is called as communication.

According to Newman and Summer:

“Communication of an exchange of facts, ideas, opinions or emotions by two or more persons.”

Question 5.

Define Insurance?

Answer:

According to Sir Thomas:

“Insurance is an arrangement which a wise person makes against imminent events, loss or misfortune, this is a devices of spreading loss.”

![]()

Question 6.

“Insurance is need of Business.” Explain.

Answer:

Under insurance on party takes the risk of all the losses of other party which are going to occur in future and against that they charge some amount which is called as premium. Hence to avoid loss or risky situation Insurance is need of Business.

Question 7.

Which person have interest at the time of having insurance?

Answer:

There should be interest kept in mind at the time of having Insurance. Employer in the life of employee, wife in the life of the husband have the interest and hence they are insurable.

Question 8.

Modern means of communication are how better than the traditional communication?

Answer:

Modern means of communication are fast and secure. They are economical as compared to the traditional system of postage. Due to modern communication system businessmen can now send information to distant places at a very minimum cost.

Question 9.

What are advantages from Banking?

Answer:

Following profits are there from the Banking:

- Encouragement to savings and capital formation.

- Transfer of savings from one sector to the another sector.

- Facility of payments.

- Proper use of financial resources.

- Balanced Regional Development.

Question 10.

Which parties have insurable interest in case of marine insurance?

Answer:

Following parties have insurable interest in case of marine Insurance:

- Interest of owner in ship.

- Owner of goods in goods.

- Shipping company in rent.

- Captain of ship and its employees in salary.

Question 11.

What is Re – insurance?

Answer:

When one insurance company transfers its some risk to another Insurance then it is called as Re-insurance.

Question 12.

Who is called as Insurer?

Answer:

The firm which do the insurance against some premium of other party and take risk of that party then the firm will be called as insures.

Question 13.

What is Insurance policy ?

Answer:

The written contract among the insurer and the insured is called an insurance policy.

Question 14.

What things are included in marine Insurance?

Answer:

- Shipping Insurance

- Insurance of Goods

- Transport Insurance.

Question 15.

Which kind of risks are insured under the general insurance?

Answer:

Under the General Insurance following insurance is done: Fire, Theft and Oce¬anic loss.

Question 16.

Write important functions of Insurance.

Answer:

Following are the functions of Insurance:

- To provides certainty

- To provide security.

- To distribute the risk.

- To be helpful in capital formation.

Question 17.

For what purpose insurance is used?

Answer:

Insurance is used to get security against the financial loss that may arise of the uncertainties in the business.

Question 18.

Write meaning of Outsourcing.

Answer:

The process of getting work done by one firm by hiring the other firm at economical rate is called as outsourcing.

![]()

Question 19.

What is computer system ?

Answer:

E – commerce business is done by the certain modes like, internet and electronic medium which requires. Order of the goods is given and received online by means of computers. For successful working of E-commerce computer system is used.

Question 20.

Write opportunity created by e – commerce?

Answer:

E – commerce provides big opportunities for the developing countries. It has made the developing countries to enter into the global market. It is also helping on reducing of the economic disparity which is existing among the developing and the developed countries.

Question 21.

Define Outsourcing?

Answer:

Outsourcing is a practice in which an individual or company perform tasks, provides services or manufactures products for another company functions that could have been or is usually done in house. It is trypically used by companies to save costs.

Question 22.

What is courier services?

Answer:

A service given by firms, organizations in which individuals in private sector exchange letters, parcels, etc. and charge fees according to weight and distance.

![]()

Question 23.

What is Hacking ?

Answer:

Illegal entry to any website is called as Hacking. Hackers can destroy data avail-able on website and can make huge loss to the owner of the website.

Question 24.

What is virus?

Answer:

There are so many virus which are existing and which have the capacity to delete all the information from the computer. Virus can enter into system by e-mail, floppy, disc drive and also from the affect – websites.

Question 25.

What is Brand Hijacking?

Answer:

By means of internet within short spam of time big brands get created. But the brands created by T.V., Radio-and Newspaper takes long time. It is also costly affairs. Internet Brand get more importance and supercite over the exiting brands. This is called as brand hijacking.

Question 26.

What is Internet connection and website?

Answer:

The important tool which is required for the e – commerce is the internet connection by the internet service provider and its website. Website contains complete information of the company e.g., Range of products, rates, proposed discount, stockiest, etc.

Question 27.

What is communication system?

Answer:

Exchange of ideas, message or information among two or more persons is called as communication. This is made either in written form, oral form or signal form through a particular communication system.

Question 28.

What is Internet?

Answer:

Internet is a world wide network. It is a network formed by connecting telephone lines to the computers all over the world. It is a form of web connected to each other. So it is called inter-network on in short internet.

Question 29.

What is meaning of E – mail?

Answer:

When information or message is sent through electronic medium through computers then it is called as E – mail.

Question 30.

What is Kisan Vikas Patra?

Answer:

Kisan Vikas Patra is one of the saving scheme of the Indian government where the invested money get doubled in 8 years and 7 month. The main aim of this scheme is to help the farmers.

Question 31.

What is Fax?

Answer:

The word fax is an acronym of for away Xerox. Any written material or document is transmitted in the same form to another place with the help of fax machine.

Business Services Short Answer Type Questions

Question 1.

Define services and goods?

Answer:

Services are essentially intangible activities which are separately identifiable and provide satisfaction of wants. We cannot kept it in stock. Their purchase does not result in the ownership of anything physical. Services involve an interaction to be realized between the service provider and the consumer.

A goods is a physical product capable of being delivered to a purchaser and involves the transfer of ownership from seller to customer. Goods also refer to commodities or items of all types, except services, involved in trade or commerce.

Question 2.

What is Bank ? Write the characteristics.

Answer:

Bank is an institution which receives deposits in order to redeem the debt of other’s mutual loans.

Characteristics of Banks are as follows:

1. Role of an intermediary:

Those who have money in excess, bank collect money from them and lend to those who are in need of it.

2. Mobilizes capital:

Small savings of the society is called by the bank and they are used in business undertakings.

3. Plays the role of Debtors and Creditors:

Bank accept deposits and then it acts as their Debtor and lend to those who are on need and hence it act as a creditor.

4. Creation of money:

Banks creates money when’they provide the facility of overdraft and credit facility.

5. Instrument of custodian:

Bank not only accept the deposits but also they safe-guard the valuables of the people such as gold, silver, etc.

6. Instruments of Accelerating are speed of capital formation : Bank accept de-posits from the people and lends to the youth for their startups.

![]()

Question 3.

Write the importance of life insurance.

Answer:

Life insurance is a kind of contract between the insurer and insured where the Insurer promises to pay certain amount of money to the insured at the death or any incidence occurrence.

Following are the importance of the life insurance:

- Life insurance is an important Business.

- It provides safety to the family, marriage of children, education of children and even at the old age.

- It makes the people to save compulsory and their money is utilized for the development of the nation.

Question 4.

Write the different types of life insurance?

Answer:

Following are the different types of life insurance:

- Whole life policy.

- Under new life policy.

- Joint life policy.

- With profit and without profit policy.

- Term policy.

- Annuity.

- Children life policy.

- Janta policy.

Question 5.

Explain the kinds of fire insurance?

Answer:

Following are the types of fire insurance:

- Specific policy.

- Valued policy.

- Average policy.

- Floating policy.

- Replacement or Re – instatement policy.

- Consequential loss policy.

- Excess policy.

- Comprehensive policy.

Question 6.

Write the types of marine insurance.

Answer:

Following are the types of marine insurance.

- Voyage policy

- Time policy

- Mixed policy

- Valued policy

- Open and Unvalued policy

- Floating policy

- Wages policy.

![]()

Question 7.

Explain different types of services.

Answer:

Services can be clarified into following types:

1. Business services:

Those services which are used by the producers in order to satisfy the wants of the consumers is called as Business services, e.g. banking, insurance.

2. Social services:

Those services which are used to uplift the standard of living of the people of the society is called as social services, e.g. medical, education, etc.

3. Personal services:

Those services which give profit to different people as per their requirement and need is called as personal services, e.g. tourism, advertisement, restaurant, etc.

Question 8.

Write the advantages of Insurance.

Answer:

Following are the advantages of Insurance:

1. Security:

When there is death in the family then it affect the whole family. By insurance the risk is distributed among the different people.

2. Encouragement to savings:

It not only assures to cover the loses of the future but also motivates the people to save.

3. Expansion of the Business:

Insurance is the distribution of the risk and helps in the expansion of the Business. With the increase in size of the business, risks also goes on increasing.

Question 9.

Explain the importance of warehousing.

Answer:

Warehousing has the following importance:

1. Storage facility:

The main aim of the warehouse is to provide the storage facility to farmers, Wholesaler, etc. When storage is done scientifically then the goods gets saved from being destroyed.

2. Risk taking:

When the goods are kept in the godown then the risk of the security of the goods is transferred to the godown owner.

3. Ease in marketing:

Warehouse provides the facility of the distribution of the goods. Goods are also graded, ranked and packed at the warehouses so that goods can be sold at the proper prizes.

4. Ease in payment of Duties:

When the goods are imported from the foreign countries then it can be kept in the warehouses without the cost.

![]()

Question 10.

Write the meaning of life insurance and its characteristics?

Answer:

Under life insurance, a person insured for a particular time – period and definite amount for insuring life, a particular amount (premium) is to be. given to the insurance company either or instalment or lump-sum which is refunded to the life insured on the completion of the term of the policy or death of the life insured, whichever is earlier.

Characteristics of life insurance:

- Life insurance is a contract which ensures to pay certain sum of money at particular event or at death.

- Subject matter of life insurance is human life.

- Insured has to give age proof and medical eligibility.

- At the time of contract at the insurance there should be availability of the insurable interest.

- In life insurance along with insurance savings of money also gets involved,

Question 11.

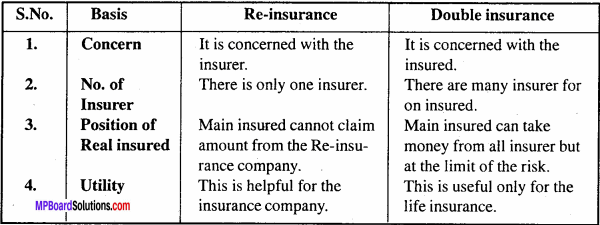

Differentiate between Re – insurance and Double insurance?

Answer:

Differences between Re – insurance and Double insurance:

Question 12.

What is mediclaim or medical insurance?

Answer:

Each and every person want to remain fit. Insurance company cannot help people in this regard but if any person get ill then is can help the person in payment of the medical requirements and bills for getting benefit it is necessary to have the mediclaim or the medical insurance. Under the mediclaim or medical insurance the insurance company promises to make the payment of certain amount or up to certain limit of the expenditure on treatment if the insured get ill.

Following expenses are included in the mediclaim policy Fees of Doctor, Expenditure on medicines, Hospital expenses, etc. now always this insurance is getting more popularity.

Question 13.

Differentiate between Life insurance and the General insurance.

Answer:

Question 14.

Is life insurance is the contract of compensation?

Answer:

Generally it is asked that whether life insurance is the contract of compensation. So it can be said in return to that it is not possible to commemorate the life of the died person. Hence contract of insurance is not the contract of the compensation. Although as per the contract of the company sum assured it.

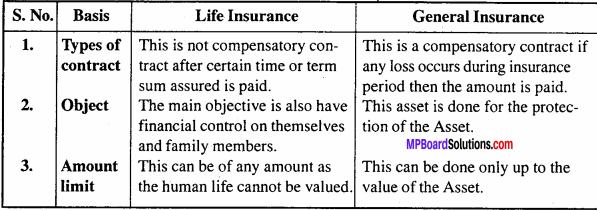

Business Services Long Answer Type Questions – I

Question 1.

Explain in detail the warehousing services?

Or

Explain warehousing and its functions?

Answer:

Warehousing was initially viewed as a provision of static unit for keeping and storing goods in a scientific and systematic manner so as to maintain their original quality, value and usefulness. But now it is viewed as a logistical service that is making available the right quantity, at the right place, in the right time, In the right physical form at the right cost.

The various warehousing services are as follows:

1. Consolidation:

The warehouse receives and consolidates materials/goods from different production plants and dispatches the same to a particular customer on a single transportation shipment.

2. Break the Bulk:

The warehouse divides the bulk quantity of goods received from the production plants into smaller quantities to be transported according to the requirements of clients to their places of business.

3. Price Stabilization:

Warehousing performs the function of stabilizing prices by adjusting the supply of goods according to demand. Thus, prices are controlled from falling when supply is increasing and demand is slack and from rising in the reverse situation.

4. Financing:

Warehouse owners provide loans to the owners on security of goods and further supply goods on credit terms to customers.

The warehouse keepers issue a receipt when goods are kept in warehouse. This receipt can be used as security to get loans from banks and owners. In this way, it also helps in financing.

![]()

Question 2.

What do you mean by mediclaim? Write its types.

Answer:

Due to sudden death of earning member the whole family gets suffered from the financial stringencies. Getting physically handicapped is again one of the biggest problem which makes the family to arrange big funds for the person treatment and a part from it, expenses for household, education of the children, etc. Hence there all things requires funds. Medical insurance can save the family from these all risks. Mediclaim or Medical insurance can help the person in two ways:

- Source of Income

- Major medical expenses.

It is of two types:

1. Basis medical expenses:

It includes admission in hospital, treatment and expenses of doctors, etc.

2. Major medical expenses:

It includes big and dangerous diseases expenses.

3. Disability income:

If any person major disability occurs then its expenses.

4. Long term hospitalization expenses.

Question 3.

What is e – banking ? What are the advantages of e – banking?

Answer:

The growth of internet and e-commerce is dramatically changing everyday, with the model world wide web and e-commerce the world is transforming into a digital global village. In simple terms, internet banking means any user with a PC and a browser can get connected to the banks website to perform the banking functions and avail the bank’s services.

e – banking refers to electronic banking or banking using electronic media. Thus, e – banking is a service provided by banks that enables a customer to conduct banking transactions, such as checking accounts, applying for loans or paying bills over the internet using a personal computer, mobile telephone or handheld computer.

Advantages of e – banking:

- e – banking provides 24 hours, 365 days a year services to the customers of the bank.

- It lowers the transaction cost.

- It inculcates a sense of financial discipline and promotes transparency.

- It reduces the load on bank branches.

![]()

Question 4.

Explain briefly the principles of insurance with suitable examples?

Answer:

The specific principles of a valid insurance contract consist of the following:

1. Utmost Good Faith:

A contract of insurance is a contract of uberrimae fidei i.e. a contract found on utmost good faith. It is the duty of the insured to voluntarily make full, accurate disclosure of all facts, material to the risk being proposed and the insurer to make clear all the terms and conditions in the insurance contract e.g.

If any person has taken a life insurance policy by hiding the fact that he is a cancer patient and later on if he dies because of cancer then insurance company can refuse to pay the compensation as the fact was hidden by the insured. ,

2. Insurable Interest:

The insured must have an insurable interest in the subject matter of insurance. Insurable interest means some pecuniary interest in the subject matter of the insurance contract. The insured must have an interest in the preservation of the thing or life insured e.g.

If a person has taken the loan against the security of a factory premises then the lender can take fire insurance policy of that factory without being the owner of the factory because he has financial interest in the factory premises.

3. Indemnity:

According to it the insurer undertakes to put the insured in the same position that he occupied immediately before the loss due to happening of the event insured against. The principle of indemnity is not applicable to life insurance e.g., a person insured a car for 2 – 5 lakh against damage or an accident case.

Due to accident, he suffered a loss of 1 – 5 lakh, then the insurance company will compensate him 1 – 5 lakh only not the policy amount i.e., 2 – 5 lakh as the purpose behind it is to compensate not to make profit.

Question 5.

Explain the utility or advantages of Internet?

Answer:

Following are the advantages of the Internet:

- By internet any information can be sent to any electronic address instantly.

- By means of that groups conversation can be made to any one and thoughts can be exchanged on any ideas.

- By internet electronic magazines can be read by paying nominal subscription amount yearly.

- By internet information can be procured related to any library museum, university or any other institutions.

- By internet any new book information can also be obtained and can be ordered electronically.

- By internet surfing various information can be obtained on Science, Literature, Music, Art, Astrology, Education, etc.

![]()

Question 6.

Write the use of Fax or importance or profit or advantages.

Answer:

Following are the advantages of Fax:

1. Instant communication:

Faxing is the fastest means of sending information. Information can also sent to distant places within minutes.

2. Simple and Ears to Handle:

It is very simple to send message through fax. Also it is very easy to operate.

3. Secrecy of Information:

Information/Messages sent by the fax machine remains secret. The information removes secret among the sender and the reciever.

4. Copy of Original:

Duplicate copy of the original is obtained by means of fax. Alternation of facts is not possible under it.

Question 7.

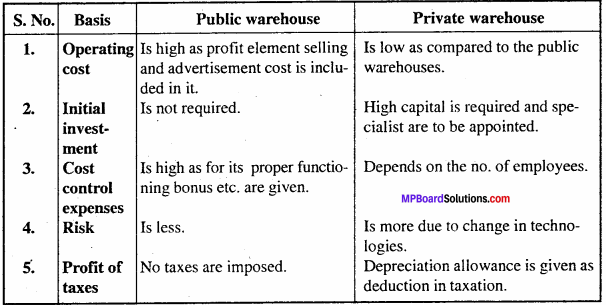

Differentiate between Public and Private warehouses.

Answer:

Differences between Public warehouse and Private warehouse:

Question 8.

What are the advantages or importance of the life insurance policy?

Answer:

Following is the importance of the life insurance policy:

1. Encouragement to save:

Life insurance give encouragement. After getting insurance policy it is very important to make the payment of insurance policy. Insured always know that if policy will not be paid then it will end the policy or policy will lapse.

2. Help in old age:

People has to suffer many problems in the old age. His earning capacity also reduces or comes to an end. Under this situation amount of the life insurance give support.

3. Profitable investment:

Investment in the insurance is always profitable as its payment is eligible for tax exemption.

4. Rebate in Income tax:

Income tax rebate is available on the payment of the insurance policy.

5. Facility of the surrender:

It due to any reason if the insured is not able to make the payment of the premium, then policy can be surrendered.

Question 9.

Write the procedure of sending E – mail?

Answer:

Following is the procedure of sending E – mail:

1. For getting the E – mail facility it is very important to open e – mail account with any of the internet service provider. Many internet providers give free facility of opening e – mail. E – mail is known by the e-mail address.

2. Now if we want to give any message through e – mail then we should know e – mail ID of the concerning person.

3. When ever any e – mail comes then through an automated system it set stored in the inbox of the concerned person. As soon as when the concerned person gets connected with internet then it is notified regarding the e – mail.

4. In order to keep the information safe and secure it can be made password protected.

Hence in this way e – mail can be sent or received by any person, institution or firm.

Question 10.

What are services? Explain their distinct characteristics.

Answer:

Services are essentially intangible activities which are separately identifiable and provide satisfaction of wants. Their purchase does not result in the ownership of anything physical. Services involve an interaction to be realized between the service provider and the consumer.

There distinct characteristics of services as discussed below:

1. Intangibility:

Services are intangible, i.e. they cannot be touched. They can only be experienced and hence the quality of the service cannot be determined before consumption. Therefore, the service providers consciously work on creating a desired service so that the customer has a favourable experience, e.g., service in a restaurant should be a favourable experience for customer to visit again.

2. Inconsistency:

Services have to be performed exclusively each time according to different consumer demands as there is no standard tangible product on offer. Hence inconsistency is an important characteristic of services. Service providers need to modify their to work meet the requirements of the customers e.g. services provided by nationalized banks are quite different from the banking services provided by private banks.

3. Inseparability:

Activities of production and consumption are performed simultaneously in case of services which makes the production and consumption of services seem to be inseparable as services have to be consumed as and when they are produced, e.g. we cannot separate the medical services provided by a doctor.

4. Absence of Inventory:

Services are intangible and perishable and hence cannot be stored for future use. This implies that the supply needs to be managed according to demand as the service has to be performed as and when the customer asks for it e.g. a medicine can be stored but the medical care will be experienced only when the doctor provides it.

![]()

Question 11.

Life insurance not only provides financial safety but also it is a kind of investment?

Or,

“Safety and Investment both factors are available in the life insurance. Do you agree?

Answer:

Yes, I agree with the statement that both the safety and investment factors are available in the life insurance because of following reasons:

1. Safety:

The main aim of life insurance is to provide safety against various risks. It saves the person from the future losses. It also provides secured feeling to the insured. With the feeling a safety and security the insured person do his works properly without bothering about peace of family. After the death of the insured the sum assured is given to the family member of.

2. Investment:

Life insurance not only provides safety to the risk but also it is a good means of investment. It gives encouragement to the savings of money as in it there is regular payment of the premium which is to be paid regularly, if the insured die before term then the insurance company provides certain amount to the nominee of (He insured and contract ends.

Question 12.

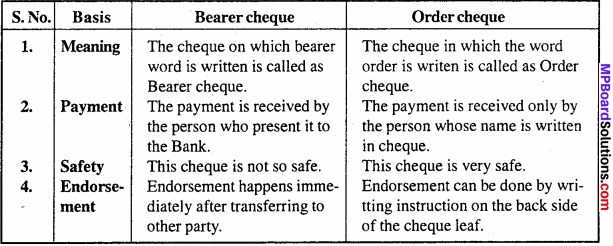

Differentiate between Bearer cheque and Order cheque?

Answer:

Differences between Bearer cheque and Order cheque.

Question 13.

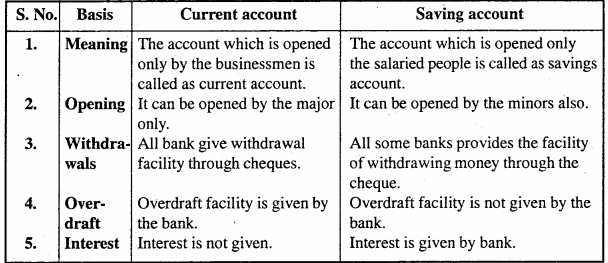

Differentiate between the Current account and Saving account?

Answer:

Differences between Current account and Saving account:

Question 14.

Explain different kinds of warehousing?

Answer:

Following are the different types of warehousing :

1. Private warehouses:

These warehouses are owned by the manufactures to store the goods manufactured or brought by them until they are sold out.

2. Public warehouses:

Public warehouses are organized to provide storage facilities to the traders, manufactures and agriculturists in return for a storage charge.

3. Government warehouses:

Many warehouses have bear constructed by the central government, state government or the local government to store their products. The ware house of state trading corporation, food corporation of India are the examples of government warehouses in which the products of the government department one stored.

4. Bonded warehouses:

A bonded warehouse is one which is licensed to accept imported goods for storage before payment of custom duty. The bonded warehouses may be either government owned or privately owned.

5. Refrigerated warehouses:

Perishable goods like fruits and vegetables, eggs, milk products, etc. are kept in these warehouses. Here the temperature is kept under control, using special devices.

6. Railway warehouses:

They are situated railway stations. Before loading the goods on train and after unloading the goods from the train they are kept the these warehouses.

![]()

Question 15.

Why insurance is necessary? Write the advantages of insurance and also its importance.

Answer:

Insurance is important in each and every part of the life. Through the insurance risk can be minimized. Nowadays the business of insurance is going on increasing drastely day – by – day. Following are the advantages of the insurance:

1. For providing security:

The main aim of insurance is to provide security against risk. When a person gets insured then after doing so that person gets free from the risk of the future. Similarly by having insurance of goods, godown, ship etc. people can minimize risk in the business.

2. Element of risk:

Along with the insurance another advantage of getting money also to be invested. After the certain time money along with bonus is handed over to the insured by the insurance company. It is like a kind of interest on the invested amount of premium.

3. Distribution of risk:

By means of insurance the. risk of one person is distributed over large number of person, e.g. many people deposit money as premium which gets converted into big amount. Whenever there is any loss to the policy holders then payment is made with this amount.

4. Facility of loan:

Loan facilities is available on the insurance e.g. if goods are insured then because of the safety purpose goods can be mortgage in order to take the loan. Hence because of the insurance also people have goodwill in the market.

5. Encourage to savings:

Under the insurance contract a certain sum has to be paid periodically. If premium is not paid on time then late fee is charged and sometime policy is forfeited or lapsed. Because of the compulsion of the payment of the premium payment people gets encouraged to save.

Business Services Long Answer Type Questions – II

Question 1.

Write a note on various telecom services available for enhancing business?

Answer:

There are various types of telecom services which facilitate business. These include:

1. Cellular Mobile Services:

These include all types of mobile telecom services including voice and non – voice messages, data services and PCO services utilizing any type of network equipment within their service area.

2. Radio Paging Services:

Radio Paging Service is a means of transmitting information to persons even when they have mobile. It is an affordable one way information broad casting solution which includes tone only, numeric only and alpha/numeric paging.

3. Fixed Line Services:

These include all types of fixed services including voice and non – voice messages and data services used to establish linkages for long distance traffic utilizing any type of network equipment connected through fibre optic cables.

4. Cable Services :

These include linkages and switched services within a licensed area of operation to operate media services which are essentially one way entertainment related services.

5. VSAT Services:

VSAT (Very Small Aperture Terminal) service is a satellite – based communications service which is highly flexible, uninterrupted and reliable communication solution for applications such as newspapers – online and tele – education in both urban and rural areas.

![]()

Question 2.

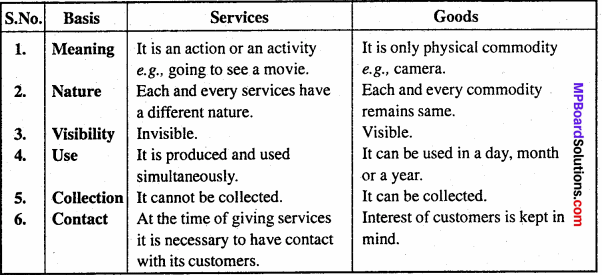

Differentiate between Services and Goods?

Answer:

Differences between Services and Goods:

Question 3.

Write a detailed note on various facilities offered by Indian Postal Department?

Answer:

The various facilities provided by postal department are broadly categorized into:

1. Financial Facilities:

Post Office Savings Bank is the largest retail bank having 15,00,00 plus branches. Financial facilities are provided through the post office’s savings schemes like Public Provident Fund (PPF), Kisan Vikas Patra, and National Saving Certificates apart from retail banking functions of monthly income schemes, recurring deposits, savings account, time deposits and money order facility.

2. Mail Facilities:

Mail services consist of parcel facilities that is transmission of articles from one place to another; registration facility to provide security of the transmitted articles and insurance facility to provide insurance cover for all risks in the course of transmission by post.

3. Allied Facilities:

(i) Greeting Post:

Indian post offers a beautiful and varied range of greeting cards for every occasion.

(ii) Media Post:

Indian corporate can use media post which is an innovative and effective vehicle to advertise their brand through postcards, envelopes, aerogram – mes, telegrams, and also through letter boxes.

(iii) Direct Post:

It is for direct advertising which can be both addressed as well as unaddressed.

4. International Money Transfer:

Indian post has a collaboration with Western Union Financial Services, USA, which enables remittance of money from 185 countries to India.

5. Passport Facilities:

Indian post has an unique partnership with the ministry of external affairs for facilitating the process of passport application.

6. Speed Post:

Indian post has over 1000 destinations covered under the speed post facility India links with 97 other countries across the globe.

7. E – bill Post:

It is the latest offering of,the Indian post and telegraph department to connect, payment across the counter for SSNL and Bharti Airtel.

Question 4.

Write advantages from the bank?

Answer:

Main advantages received from this banks are as follows:

1. Saving Habit:

Bank encourages the habit of savings among the people. By having an account in the bank, depositors and develop a habit and in this way fund accumulated which proves helpful at the time of need.

2. Protection of Valuable Assets:

Banks provide locker facility to its customers in which they can keep their valuable belongings, like important documents, ornaments, gold and diamond safe.

3. Capital Formation:

Banks accumulates the dispersed capital in the country and provides to them who need it. It influences the trading, business, production activities of a country. In this way banks play a vital role in the commercial and industrial development of a country by capital formation.

4. Transfer of Funds:

Bank is the best medium of transfer of funds. Through banks, funds can be transferred from one corner of the country to other. It also helps to send money to foreign countries because their branches are spread in many countries of the world.

5. Facility of Travellers Cheque:

Bank issues traveller’s cheque which when presented to any branch of the same bank, it can be encashed in moments. In this way, it helps a person not to carry much cash with himself and he is also safe from the fear of loosing cash while travelling.

6. Facility of Payment:

Both parties are benefited if payment is done through bank. There is no need-to count cash or test any currency note. Also bank issues cheques, drafts, etc. which acts as a proof of the payment for the payer.

Question 5.

Describe various types of insurance and examine the nature of risks protected by each type of insurance.

Answer:

Insurance may be classified as follows:

1. Life Insurance:

A life insurance policy protects against the uncertainty of life though its scope has now widened to suit the various insurance needs of an individual like disability insurance, health/medical insurance, annuity insurance and life insurance proper.

There are various types of life insurance policies like:

- Whole Life Policy

- Endowment Life Assurance Policy

- Joint Life Policy

- Annuity Policy

- Children’s Endowment Policy.

2. Fire Insurance:

Fife insurance is a contract whereby the insurer, in consideration of the premium paid undertakes to make good any loss or damage caused by fire during a specified period up to the amount specified in the policy. The fire insurance policy is generally taken for a period of one year after which it is to be renewed from time – to – time. A claim for loss by fire is considered valid only if it satisfies the following two conditions:

- There must be actual loss and

- Fire must be accidents and non – intentional.

3. Marine Insurance:

A marine insurance contract is an agreement whereby the insurer undertakes to indemnify the insured in the manner and to the extent thereby agreed against marine losses. Marine insurance provides protection against loss by marine – perils or sea – perils. There are three things involved in marine insurance:

1. Ship or Hull Insurance:

Since the ship is exposed to many dangers at sea, the insurance policy is for indemnifying the insured for losses caused by damage to the ship.

2. Cargo Insurance:

An insurance policy can be issued to cover against the risks to cargo while being transported by ship. These risks may be at port, risk of the lost goods or on goods is Transit, etc.

3. Freight Insurance:

Shipping company is insured under freight Insurance for reimbursing the loss of freight to the shipping company. If the cargo does not reach the destination due to damage or loss in transit.

![]()

Question 6.

What is Monthly Income Scheme? Write its characteristics.

Answer:

Monthly income scheme is the scheme of the postal department in which any person can deposit certain amount and can get interest on monthly basis up to certain time period along with maturity and principal. This scheme is very helpful to the retired persons or who want to deposit big amount in lump sum.

These person can get monthly interest by depositing big amount at one time. This scheme do not let the person the feeling of non – getting of salary as it provides monthly amount which is a kind of small salary to them every month.

Characteristics of Monthly Income Scheme:

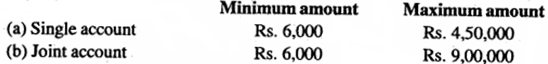

1. Investable amount:

Following limitations of amount to be invested in single and joint account minimum and the maximum amount is as under:

2. Maturity term:

Maturity term is of 5 years in this account. If money is deposited then interest will be paid up till end of the 5 years and at the end of 5 years principal amount will be paid back.

3. Passbook:

After opening monthly income scheme account, the depositor gets one passbook in which all the details like name, address, maturity value, deposit amount, etc.

4. Number of accounts:

One person can open only one monthly income scheme account and single account deposit amount maximum will be 4 – 5 lakh and for joint account 9 – 0 lakh.

5. Convertibility:

One single MIS can be converted into joint account also and joint account can be converted into single account also.

6. Nomination:

Nomination facility is available in this account.

7. Position of minor:

MIS can be opened in the name of minor also. Any person having age 12 years or more can open and operate this account.

Question 7.

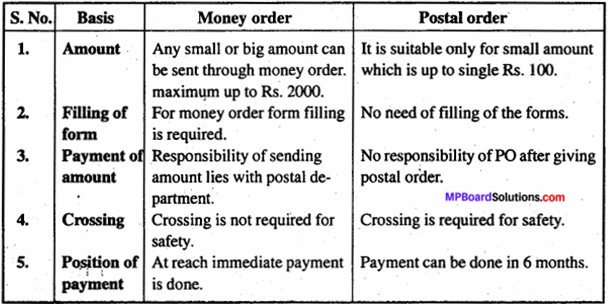

Differentiate between Money order and” Postal order?

Answer:

Differences between Money order and Postal order:

Question 8.

Explain the different types of warehouses?

Answer:

In business and trade, following warehouses are prevalent:

1. Private warehouses:

These warehouses are owned by the manufacturers to store the goods manufactured or brought by them until they are sold out. Manufacturers generally hold goods back until the conditions are suitable. Merchants also find it more convenient to deliver goods directly from their own warehouses.

2. Public warehouses:

Public warehouses are organized to provide storage facili-ties to the traders, manufacturers and agriculturists in return for a storage charge. Anybody can keep his goods in the public warehouses by paying the necessary charges.

3. Government warehouses:

Many warehouses have been constructed by the Cen-tral Government, State Government or the Local Government to store their products. The warehouses of State Trading Corporation, Food Corporation of India are the examples of government warehouses in which the products of the government departments are stored.

4. Bonded warehouses:

A bonded warehouse is one which is licensed to accept imported goods for storage before payment of custom duty. The bonded warehouses may be either government owned or privately owned.

5. Refrigerated warehouses:

Perishable goods like fruits and vegetables, eggs, milk products, etc. are kept in these warehouses. Here the temperature is kept undo control using special devices.

6. Railway warehouses:

They are situated at railway stations. Before loading the goods on goods train and after unloading the goods horn the goods train, they are kept in these warehouses.

7. Other warehouses:

- Warehouses of banks

- Warehouses of village area

- Warehouses of storage corporation, etc.