MP Board Class 11th Accountancy Important Questions Chapter 6 Subsidiary Books-II

Subsidiary Books-II Important Questions

Subsidiary Books-II Objective Type Questions

Question 1.

Choose the correct answers:

Question 1.

Cash purchase of goods is recorded in –

(a) Purchase book

(b) Sales book

(c) Cash – book

(d) None of these.

Answer:

(c) Cash – book

Question 2.

Credit purchase of furniture shall be recorded in –

(a) Purchase book

(b) Journal book

(c) Cash – book

(d) None of these.

Answer:

(b) Journal book

![]()

Question 3.

Who prepares a debit note –

(a) Saler

(b) Purchaser

(c) Cashier

(d) None of these.

Answer:

(b) Purchaser

Question 4.

Return of goods by a customer is recorded in –

(a) Purchase book

(b) Sales book

(c) Sales return book

(d) Purchase return book.

Answer:

(c) Sales return book

Question 2.

Fill in the blanks:

- The purchase of packing material along with goods purchased is recorded in ……………

- Such transactions for which no separate subsidiary books are maintained are recorded in ……………..

- Sub – division of Journal is called …………….

- Credit note is sent to …………….

Answer:

- Purchase book

- Journal book

- Subsidiary book

- Purchaser.

Question 3.

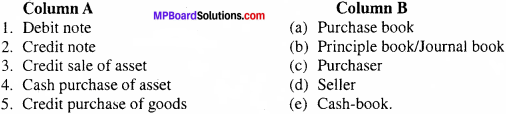

Match the following:

Answer:

1. (c)

2. (d)

3. (b)

4. (e)

5. (a).

![]()

Question 4.

Answer the following in one word/sentence:

- Mention the transaction which is not recorded in purchase book?

- Credit sale of goods is recorded in which book?

- Interest on capital is recorded in which subsidiary book?

- Which discount is recorded in purchase and sales book?

Answer:

- Cash transaction

- Sales book

- Journal book

- Trade discount.

Question 5.

State True or False:

- Purchase book is a principle book.

- Preparation of sales account is not essential when sales book is maintained.

- Goods received on consignment is recorded in purchase book.

- Cash sale of asset is recorded in main journal book.

Answer:

- False

- False

- False

- False.

Subsidiary Books-II Short Answer Type Questions

Question 1.

Why a purchases account is opened when a purchases day book is already kept in the business?

Answer:

Due to the following reasons, a purchases account is opened when a purchases day book is kept:

- In purchases day book, only credit purchases are entered. But in the business both cash and credit purchases take place usually. Hence, from purchases day book complete information regarding purchases is not obtained.

- The total of purchases day book is less than purchases account. This is because in purchases account both cash and credit purchases of goods are entered.

- By transferring the total of purchases returns book to purchases day book, the net purchases can be obtained.

Question 2.

Explain the advantages of subsidiary books.

Answer:

The various advantages of subsidiary books are as follows:

- Division of work – The accounting work will be divided amongst a number of clerks as there are so many subsidiary books.

- Saves time – By using a number of books, various accounting processes can be undertaken simultaneously. This helps the work to be completed quickly.

- Easy availability of information – Since a separate register is kept for each class of transaction, the information relating to each transaction will be available easily.

- Less chances of misappropriation – By division of work, there are no chances of misappropriation of accounts.

- Safety of accounts – There is no danger of loss of accounts even if one book of accounts is lost because relevant information may be obtained from other books.

![]()

Question 3.

What do you understand by purchase and sales returns book?

Answer:

Purchase return book:

It is a subsidiary book where the purchased goods that are returned to the supplier are recorded. It is also known as return outward book.

Sales return book:

It is a subsidiary book where the sold goods that are returned by the purchasers are recorded. It is also known as return inward book.

Subsidiary Books-II Long Answer Type Questions

Question 1.

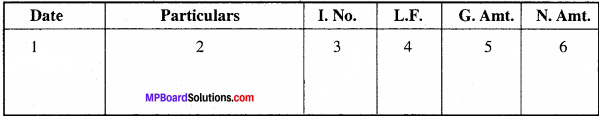

Prepare the format of a subsidiary Book and show the method of writing.

Answer:

- Date – Date of transaction is mentioned.

- Particulars: Name of purchaser and seller is written.

- Invoice No. is written.

- Page No. (Ledger folio) is mentioned.

- Amount is written in which adjustments are done.

- Net amount after adjustment is written.

Question 2.

What is journal proper? Why it is prepared?

Answer:

According to the rules of Double Entry System, each transaction is to be entered in any of the subsidiary books. But there are some transactions which are not entered in any of the subsidiary books. They are to be entered in a separate book, which is known as journal proper.

The following transactions are entered there:

- Opening entries

- Transfer entries

- Rectifying entries

- Adjustment entries

- Closing entries

- Miscellaneous entries.

Thus, journal proper serves this purpose.

![]()

Question 3.

What is the importance of sales and sales return book in the business? (Any five points)

Answer:

Importance of sales and sales return book:

- From, sales book – total credit sales can be known easily.

- Similarly total debtor can be known and accordingly credit sales can be controlled.

- Due to writing of credit sales separately, the chances of error minimises.

- From sales return book, it is known that how much goods are returned and for what reasons. This helps in checking and controlling these errors.

- Sales returns helps to know correct amount of debtors as the value of sales return is deducted from sundry debtors.