MP Board Class 11th Accountancy Important Questions Chapter 10 Rectification of Errors

Rectification of Errors Important Questions

Rectification of Errors Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Errors are rectified in this book –

(a) Ledger book

(b) Journal proper

(c) Trial balance

(d) None of these.

Answer:

(b) Journal proper

Question 2.

Errors Committed by omitting entries in the Journal book is called –

(a) Error of commission

(b) Error of principle

(c) Error of omission

(d) None of these.

Answer:

(c) Error of omission

![]()

Question 3.

If the trial balance does not tally after many efforts then following Account is opened –

(a) Purchase account

(b) Suspense account

(c) Sales account

(d) None of these.

Answer:

(b) Suspense account

Question 4.

Errors committed due to lack of basis principle of Accounting are called –

(a) Compensating errors

(b) Error of principle

(c) Single sided error

(d) None of these.

Answer:

(b) Error of principle

Question 2.

Fill in the blanks:

- Errors committed while totalling, balancing of Accounts are called ……………

- …………… errors are disclosed by Trial balance.

- If one error nullifies the effect of another error, such errors are called …………….

- Suspense Account is a ……………. Account.

Answer:

- Arithmetical errors

- Arithmetical

- Compensating errors

- Temporary.

Question 3.

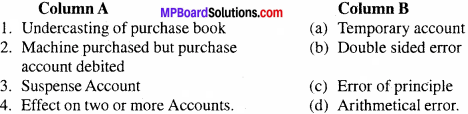

Match the following

Answer:

1. (d)

2. (c)

3. (a)

4. (b).

Question 4.

Answer in one word/sentence:

- The entries passed in the Journal proper for rectifying entries are called.

- The total of purchase book was written Rs. 200 instead of Rs. 2,000. This is an example of.

- When two errors nullify each others effect, then such errors are called.

- When are rectifying entries passed?

Answer:

- Rectifying entries

- Error of casting

- Compensating errors

- Beginning of the year.

![]()

Question 5.

State True or False:

- Suspense Account is a Permanent Account.

- Single sided errors are generally rectified directly in the ledger accounts before closing the accounts.

- Final accounts are not affected through rectification of errors.

- Single sided errors are rectified through Suspense Account.

Answer:

- False

- True

- False

- True.

Rectification of Errors Short Answer Type Questions

Question 1.

Write some errors which are disclosed by a trial balance?

Answer:

The following are some of the errors which are disclosed by a trial balance:

- Wrong posting in an account.

- Double posting of an entry in an account.

- Entry of wrong amount in an account.

- Entry of one side posting.

- Error in bringing down the balance forward in new page.

- Error in balancing of account.

Question 2.

How the errors can be rectified? Explain.

Answer:

After the errors are located, it is essential to rectify them. Rectification can be made into three ways. They are:

- Cut the figures or by erasing the old figures and make it correct.

- Write rectification entries directly in the books of accounts.

- Write rectification entries in the journal.

Cut the figures or erasing the old figures and make it correct is wrong according to the principles of double entry system. By doing so, the validity of accounting is abolished. Rectification of entries in the ledger accounts or in the journal is made after the completion of financial year.

![]()

Question 3.

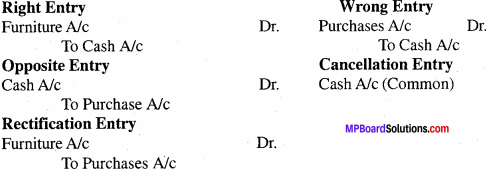

How the double sided errors are rectified? Explain.

Answer:

The double sided errors are rectified through journal entries, where one account is debited and the other account is credited.

For the rectification of double sided error, the following steps are to be remembered:

- Make the correct entry as per the principles of double entry system.

- Repeat the wrong entry, which is done in the books of accounts.

- Make the opposite entry of wrong entry.

- Compare the correct entry with opposite entry and strike off the common entry. The resulting entry is the rectification entry.

Example: Ram purchased a furniture, which was debited in purchases account.

Question 4.

What do you mean by suspense account? On which circumstances transactions are entered there?

Answer:

After the errors have been located, they must be rectified and the Trial balance should be tallied. This is done by transferring the difference into a special account called suspense account. It is temporary and fictitious account. In future, when the errors are located, the entries for their rectifications are done in this account. The suspense account will debited if the total of the credit column of trial balance exceeds the total of credit column, it will be credited in the other case.

In the following circumstances transactions are entered there:

- A transaction is completely omitted

- One sided errors

- Unlocated errors

- Disagreement of trial balance.

Rectification of Errors Long Answer Type Questions

Question 1.

How gross profit, net profit and balance sheet are affected by rectification of errors? Explain.

Answer:

The gross profit, net profit and balance sheet are affected by the rectification of errors. It is as follows:

1. Effect on gross profit – If the credit side of trading account is increasing due to the rectification entry, the gross profit will also increase. On the other hand, if the debit side of the trading account is increased due to rectification, the gross profit will be reduced.

2. Effect on net profit – If the credit side of profit and loss account is increased due to. the rectification, the net profit will increase and vice versa. Thus rectification affects net profit.

3. Effect on balance sheet – The effect on net profit result the increase or decrease in capital balance, i.e., it will affect the total assets and liabilities in the balance sheet.

![]()

Question 2.

Mention the errors which are disclosed by trial balance.

Answer:

The following are some of the errors which are disclosed by a trial balance:

- Wrong posting in an account.

- Double posting of an entry in an account.

- Entry of wrong amount in an account.

- Entry of one side posting.

- Error in bringing down the balance forward in new page.

- Error in balancing of account.