MP Board Class 11th Accountancy Important Questions Chapter 7 Ledger

Ledger Important Questions

Ledger Objective Type Questions

Question 1.

Choose the correct answers:

Question 1.

What statement is used while closing a Drawing Account –

(a) Balance c/d

(b) By Trading A/c

(c) By P & L A/c

(d) By Capital Account.

Answer:

(d) By Capital Account.

Question 2.

The entry which is passed for bringing forward the balances of personal and Real Account as shown in the last year’s balance sheet is called –

(a) Closing entry

(b) Journal entry

(c) Opening entry

(d) None of these.

Answer:

(c) Opening entry

Question 3.

The balance of good’s Account is transferred to –

(a) Profit and loss Account

(b) Trading Account

(c) Balance sheet

(d) None of these.

Answer:

(b) Trading Account

![]()

Question 4.

Which Account is opened first in ledger book –

(a) Personal

(b) Real

(c) Non – real

(d) None of these.

Answer:

(a) Personal

Question 5.

How many columns are there in a Ledger (in one side) –

(a) Six

(b) Four

(c) Five

(d) Seven.

Answer:

(b) Four

Question 2.

Fill in the blanks:

- Ledger posting is done on the basis of ……………..

- ……………. of transaction is not written in Ledger Account.

- The recording of page number from subsidiary books to Ledger book and vice versa is called ……………..

- The balance of Income and Expenditure Accounts is transferred to ……………..

Answer:

- Journal book and Subsidiary book

- Narration

- Folioing

- Profit and loss Account.

Question 3.

State True or False:

- The word ‘By’ should be used always while making and entry in debit side of an account.

- The debit balance of personal accounts denotes debtors.

- The balance of goods accounts is transferred to trading account.

- Ledger book does not possess legal acceptability.

- In ledger narration is not required.

Answer:

- False

- True

- True

- False

- False.

![]()

Question 4.

Answer in one word/sentence:

- The book in which accounts relating to person, goods, income and expenditure is maintained and transactions are recorded is called.

- On which date account are closed?

- Sales account always shows which balance?

- The process of totaling the debit and credit side of a ledger account is called.

Answer:

- Ledger book

- Last day of the month or year

- Credit balance

- Closing of account.

Ledger Short Answer Type Questions

Question 1.

What is a ledger account?

Answer:

The head on which the transactions pertaining to a particular person, asset, liability, expense, income, etc. are entered in the books is called account. It should have two sides Debit side and Credit side. They are classified as-Real account. Personal account and Nominal account.

Question 2.

Explain the need of ledger accounts.

Answer:

The importance of ledger accounts are:

- Knowledge of accounts – In ledger, all the transactions of same nature are written at one place. A trader may know the position of every account very easily.

- Information – A trader may get every sort of information from the ledger. He may know what he owes to others and what is due from others.

- Knowledge of profit – A trader may ascertain his profit or loss easily for a particular period from profit and loss account which is prepared from ledger accounts.

- Economy of time – Ledger make the information readily available, this saves a lot of time.

- Test of accuracy – On the basis of ledger, trial balance is prepared which is a token of checking arithmetical accuracy of the accounts.

Question 3.

Explain the procedure of transferring journal entries from the journal to the ledger accounts.

Answer:

When the entries are transferred from journal to ledger accounts, the following points are remembered:

- Always the entries are transferred from journal.

- In ledger, accounts related to real, personal and nominal accounts are opened.

- Each account should be opened in prescribed form only.

- If one account is debited in journal, in ledger, the other account is transferred in the same side. In the same way, if an account is credited in journal, in ledger, the other account is entered in the credit side.

- In particulars column, each account starts with the word ‘To’ in debit side and with the word ‘By’ in credit side.

- In a particular ledger account, the same account is not entered in particular column.

Question 4.

Name five accounts which always have credit balance.

Answer:

Following accounts represent always debit balance:

- Capital account

- Sales account

- Purchase returns account

- Out – standing expenditure account

- Creditors account.

![]()

Question 5.

What is meant by ‘Ledger Folio’?

Answer:

Ledger folio (L.F.):

This is shown in the journal as the third column. In this column it is written with corresponding page number of the particular account in ledger. It saves time and energy to the book – keeper to find out respective account from the ledger.

Question 6.

Why is posting done?

Answer:

From the balances extracted from ledger book, Trial balance is prepared which ultimately helps to prepare final accounts. Only journal entries cannot help a trader to know about the Debtors, Creditors, Balances of real accounts of the business. Hence, posting is done in ledger accounts. This book can be present in court, in case of any dispute, as proof.

Question 7.

Explain the need of opening entry.

Answer:

Due to the following reasons opening entries are made:

- It gives a green signal to the book – keeper to start writing the books of accounts for the current year.

- Another important need is that a book – keeper will not be able to tally a trial balance unless he brings forward the closing balances of previous year.

Question 8.

Explain the need of closing entry? Mention few characteristics.

Answer:

Closing entries are made necessarily for two reasons:

Firstly, nominal accounts relate to one accounting period only and must be closed when that period is over. Secondly, the balances of nominal accounts must be transferred to trading and profit and loss account, so that the net result of the business for the period can be ascertained.

Characteristics:

- It is done in subsidiary book.

- It is done only once at the end of the year.

- Its main object is to close goods accounts and other accounts.

Ledger Long Answer Type Questions

Question 1.

Explain the method of balancing and closing ledger accounts.

Answer:

All the journal entries are transferred to ledger accounts for a particular period. Then these ledger accounts are totalled and balanced. By doing so, the accounts are being closed. For balancing an account, the totals of debits and credits are find out separately. Then, the difference of their totals are calculated and this difference is known as balance.

1. If the debit total is more than credit total, it is said to be debit balance. After finding the balance it is written as ‘By Balance c/d’ in the credit side just above the total. Then this amount is transferred to debit side as ‘To Balance b/d’ in the new accounting year.

2. If the credit total is more than the debit total, it is said to be credit balance in the debit side it is entered with ‘To balance c/d’ just above the total. Then this balance is transferred to the credit side as ‘By Balance b/d’ in the new accounting year.

3. The balances of personal and real accounts are transferred. The accounts relating to goods account are transferred to trading account and balances of nominal accounts are transferred to profit and loss account at the end of the year.

![]()

Question 2.

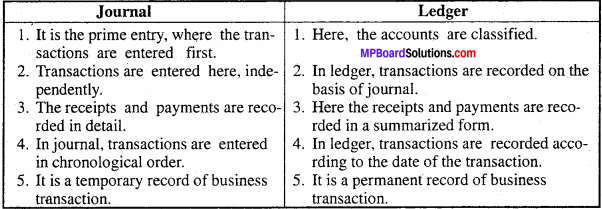

Differentiate between journal and ledger.

Answer:

The following are the differences between journal and ledger:

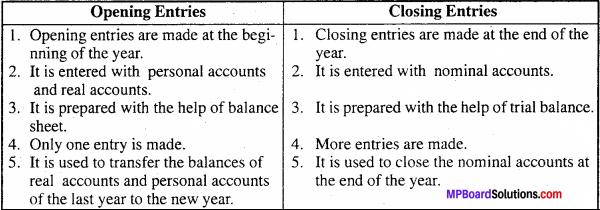

Question 3.

Differentiate between opening entries and closing entries.

Answer:

Following are the differences between opening entries and closing entries:

Question 4.

What is Endorsement? Explain its Merits.

Answer:

Endorsement of a Bill:

Endorsement of a bill means when drawer or the holder of a bill, transfer and delivered it in favour of his creditor to settle his account. Bill is a negotiable instrument which can be endorsed or transferred. The drawer who endorses the bill is called endorser and the person who receives the bill under endorsement is called endorsee. The result of endorsement of bill is that payment can be recovered by endorsee only. For endorsement of bill the drawer puts his signature on the face of the bill and gives it to his creditor in settlement of his account.

In transactions relating to endorsement of bill (i) The writer of bill or drawer or endorser and (ii) The receiver of bill or endorsee are only affected. So, endorsement entries are entered in the books of endorser and endorsee. Acceptor (drawee) is not affected in this transaction. Therefore, in his book no journal entries related to endorsement of bill are entered.

Endorsement of the bill to any other person by the endorsee:

If the drawer had endorsed the bill to a person and that person again endorses the bill to any other person and that person to any other person again.