MP Board Class 11th Accountancy Important Questions Chapter 15 Adjustments

Adjustments Important Questions

Adjustments Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Outstanding Expenses are related to –

(a) Current year

(b) Next year

(c) Last year

(d) None of these.

Answer:

(a) Current year

Question 2.

Prepaid expenses are shown in –

(a) Liability side

(b) Asset side

(c) Assets or Liability side

(d) None of these.

Answer:

(b) Asset side

Question 3.

Charity of goods is –

(a) Expenses

(b) Loss

(c) Profit

(d) None of these.

Answer:

(b) Loss

![]()

Question 4.

If a person fails to pay his debt, such amount is considered as –

(a) Bad debts

(b) Bad debts recovered

(c) Provision for Bad debt

(d) None of these.

Answer:

(a) Bad debts

Question 5.

The object of non – trading concerns –

(a) Social service

(b) Profit earning

(c) Both of these

(d) None of the above.

Answer:

(a) Social service

Question 2.

Fill in the blanks:

- Goods given in charity is credited in …………… Account.

- Such Expenses which are paid in current year but are related to next year are called ……………. expenses.

- Accrued income is ……………. Account.

- There is ……………. fall in the value of Asset due to depreciation.

- Interest on capital is always shown in …………….. side of profit & loss A/c.

- Unearned income is shown on the ……………….. side of balance sheet.

Answer:

- Purchase

- Prepaid expenses

- Personal account

- Constant/ gradual

- Debit

- Liability.

Question 3.

Match the following:

Answer:

1. (c)

2. (d)

3. (b)

4. (a).

Question 4.

Answer in one word/sentence:

- Such Expenses for which services have been received but amount is yet to be paid are called.

- Recording of relevant transactions and eliminating non – related transactions is called.

- Such income which is earned but not yet received is called.

- Unearned income is recorded in which side of the balance sheet?

Answer:

- Outstanding Expenses

- Adjustment

- Accrued or Earned Income

- Liability side.

![]()

Question 5.

State True or False:

- Depreciation is charged only in case of profits.

- Unearned Income is recorded in Asset side.

- Interest on Capital is income for the business.

- Drawing of goods is deducted from purchases.

Answer:

- False

- False

- False

- True.

Adjustments Short Answer Type Questions

Question 1.

What do you mean by adjustments? What are its object?

Answer:

Sometimes certain transactions may be partially or fully omitted by mistake or wrongly entered. Besides this, there are some incomes or expenses which are related to the next year or of the last year, which are received or paid during the current year, if they are including in the current years. Final accounts, it will not show a correct net profit or net loss. So, they must be adjusted. It is called adjustments.

1. To record the related expenses and Income, of the year – It is essential to record all expenses and incomes of the related year while preparing the Final Accounts. Otherwise, it will not produce a true picture of net profit or net loss and financial position of the business.

2. To separate unrelated expenses and incomes of the business – Sometimes there are chances of unpaid amount or incomes received in advance. These items must be excluded. For this purpose, adjustments are necessary.

3. To make provision for future loss – Possibility of loss in future is always exist in the business. In order to overcome these loss like bad debt etc. a provision is required to be maintained in the business.

4. To provide depreciation – Various assets are continuously used in the business. Due to its constant use, their value decreases which is termed as depreciation. Thus, it is essential to make record of it as a business expense.

5. To rectify errors – To make rectification of errors made while recording, posting or balancing of accounts, adjustment entries are needed.

6. To make complete record – To make record of one individual items of the trading year related with interest on capital, interest on drawings, interest on loan etc. in the final accounts, adjustments are necessary.

![]()

Question 2.

Write adjustment entries of depreciation.

Answer:

1. Depreciation A/c Dr.

To Assets A/c

(Being depreciation charged on asset)

2. Profit & Loss A/c Dr.

To Depreciation A/c

(Being depreciation transferred)

To P&L A/c

Question 3.

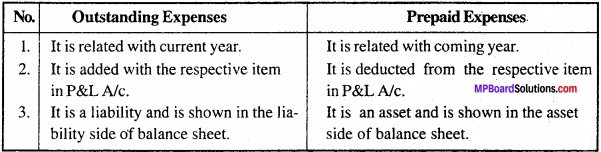

Differentiate between outstanding expenses and prepaid expenses.

Answer:

The following are some of the differences between outstanding expenses and prepaid expenses:

Question 4.

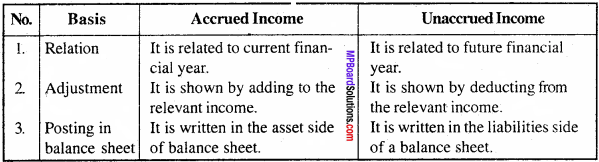

Differentiate between accrued income and unaccrued income.

Answer:

The ahead are some of the differences between accrued and unaccrued income:

Question 5.

How the debtors can be classified? Explain.

Answer:

Debtors are those persons who debted to the business or liable to pay the amount to the business. On the basis of recoverability of amount, debtors can be classified into three ways. They are:

- Good debtors – Good debtors are those debtors who are expected to make their payment in time, i.e., Full amount is expected to recover from them.

- Doubtful debtors – Doubtful debtors are those debtors from whom doubt is arising regarding their payment, i.e., Their payment is in doubtful condition.

- Irrecoverable or bad debt – From these debtors no amount is expected to receive. It arises when debtor dies, becomes lunatic, mad or the court declares insolvent. It is a business loss.

Question 6.

Why a provision for discount on debtors and creditors are maintained in the business?

Answer:

Discount provision on sundry debtors:

When the sundry debtors make their payment before the prescribed time, they are allowed some concession. This concession is called cash discount. It is a loss to the business. In certain condition, the trader keeps a reserve to allow discount on debtors for future, in anticipation. This reserve or provision is known as discount provision on sundry debtors. It is calculated after the deduction of further bad debt and new reserve from debtors at a percentage. This amount is shown in the debit side of profit and loss account and is also deducted from debtors in the balance sheet.

Discount provision on sundry creditors:

When the trader makes the payment before the stipulated time, he is allowed some discount. It is an income of the business. In certain condition, the trader keeps a reserve in anticipation that some discount may receive in future. This reserve on provision is called, ‘Discount provision on sundry creditors’. It is shown in the credit side of P&L A/c and is deducted from the sundry creditors in the balance sheet.

![]()

Question 7.

Show adjustment entry for adjustment of interest on capital and interest on drawings.

Answer:

Interest on Capital

Interest on Capital A/c Dr. –

To Capital A/c –

(Being interest on capital adjusted)

Interest on Drawings

Drawing A/c Dr. –

To Interest on Drawings A/c

(Being adjustment of intertest on drawing)

Question 8.

Explain Accrued income and unaccrued income.

Answer:

Accrued income:

Accrued income is such type of an income which is due but not received. It is an outstanding amount to receive. Here, the journal entry is:

Accrued Income A/c Dr.

To Income A/c (Being income accrued)

Unaccrued Income:

Unearned income is such type of an income, where an income received in advance, but the service is not offered or the income received is applicable to the coming period. Here, the journal entry is:

Income A/c Dr.

To Unearned Income A/c –

(Being income unearned)

Question 9.

Explain how the following adjustments are done in final accounts.

- Outstanding wages

- Outstanding salary

- Accrued rent

- Unearned commission.

Answer:

- Outstanding wages – In trading accounts the amount of outstanding wages is added to the respective item and such outstanding amount is shown in the liability side of balance sheet.

- Outstanding salary – The amount of outstanding salary is added to the respective item in profit and loss account and such outstanding amount is shown in the liability side of balance sheet.

- Accrued rent – The amount of accrued rent is added to the respective item in profit and loss account and the accrued amount is shown in the asset side of balance sheet.

- Unearned commission – The amount of unearned commission is deducted from the respective item in profit and loss account and is shown in the liability side of balance sheet.

Question 10.

How is manager’s commission calculated on net profit? Where and how is the adjustment done?

![]()

Mannager’s commission on net profit:

Shown in the debit side of profit and loss account and shown separately in the liability side of the balance sheet after the calculation.